Over the past decade, two important trends have defined the Great Britain (GB) electricity market:

a rapid transition to renewable energy and it becoming one of the world leaders in clean electricity, especially offshore wind

A rapid increase in electricity prices and it becoming one of the world leaders in highest energy prices

These headline trends have turned fossil fuel lobbyists into ‘correlation = causation’ enthusiasts to argue that transitioning to a Net Zero power system would be prohibitively expensive. GB, being a world leader in renewable deployment is being showcased as a cautionary tale to other, less decarbonised countries. A deeper dive into the underlying mechanisms of the GB energy market paints a completely different picture.

The Anatomy of GB Electricity Bill

The electricity bill in GB is made up of several components:

Wholesale energy costs: ~36% of the bill in 2024. This is the cost of buying electricity from generators on the market. It’s the most volatile and biggest part of the bill, driven largely by fuel prices

Network charges : ~24% of the bill in 2024. These fees cover building and maintaining the grid – the wires and infrastructure that deliver power.

Environmental and social levies: ~16% of the bill in 2024. These “policy costs” fund renewables subsidies (like the Renewables Obligation and Feed-in Tariffs for early solar adopters. These are expected to be phased out once the early adopter renewable projects come offline) and social programs (like discounts for vulnerable customers and home insulation schemes). This portion is sometimes dubbed "green levies" in the media.

Operating costs: ~14% of the bill. This covers the energy supplier’s business costs – customer service, billing systems, metering, etc.

Supplier pre-tax margin: A very small slice (around 0% on average, sometimes even negative during the crisis). It represents supplier profits (or losses)

VAT (tax): 5% on household energy in the UK, which amounts to about 4–5% of the bill.

About 80% of a GB electricity bill is determined by wholesale costs, network charges, and levies. Of these, wholesale cost is the largest and most volatile component (with any ‘green levies accounting for 16%, expected to go down to zero gradually) – and this is exactly where the story flips on its head.

For more details on electricity bill breakdown and to play around with your own data, check out the website Electricity Bill Breakdown by

.

Wholesale Electricity Costs: Who’s at the Margin?

The electricity system in GB uses a marginal price system to determine the final cost of electricity. That means that the final price passed on to consumers is solely dependant on what price the most expensive generator is charging. This can be visualised through a supply demand illustration with merit order of different generators.

Unlike other commodity markets, electricity transmission needs to match supply and demand at every instant. This is required to maintain the stability of the grid.

Wind and solar are not ‘dispatchable’ generation i.e. the output you get at any given time is dictated by weather. The benefit of this is that the marginal cost of generation for these renewable technologies is near zero (don’t need to pay for wind blowing or sun shining, yet!). This would work great in a marginal price, except currently it would be very rare for them to be at the margin at all.

GB, despite being a leader in renewable capacity deployment, hasn’t reached the stage where renewables can satisfy 100% of the demand (i.e. be at margin) for a material number of hours in a year. This means renewables generation has nearly negligible impact on the pricing of wholesale electricity in a marginal price system. It doesn't matter how strong the wind blows or the sun shines, unless a certain capacity threshold is achieved, the price will only be dictated by the marginal technology. In fact, through their zero marginal pricing, renewable energy applies a downward pressure on pricing.

For more insights into marginal price

And here’s the kicker, its gas-powered plants which set the price >90% of the time.

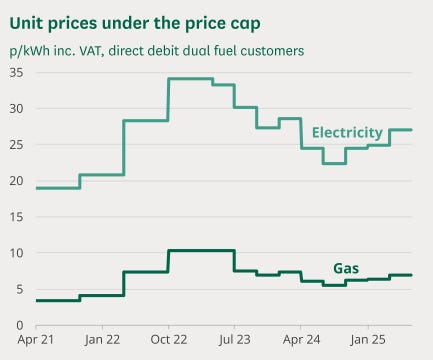

Gas price has spiked several times in GB in the recent past, especially post the Ukraine crisis.

Lets map this to the electricity price.

Corelation = Causation now?

Looking forward and why GB is not the best case study

So why is gas price so expensive in GB? One factor is after the start of Ukraine crisis gas price spiked across the world, & not just here. In addition, compared to other markets such as US, GB relies on more expensive LNG imports with high transportation costs than domestic production such as shale. There are also additional factors such as limited storage capacity and currency exchange rates which drive the price of gas up.

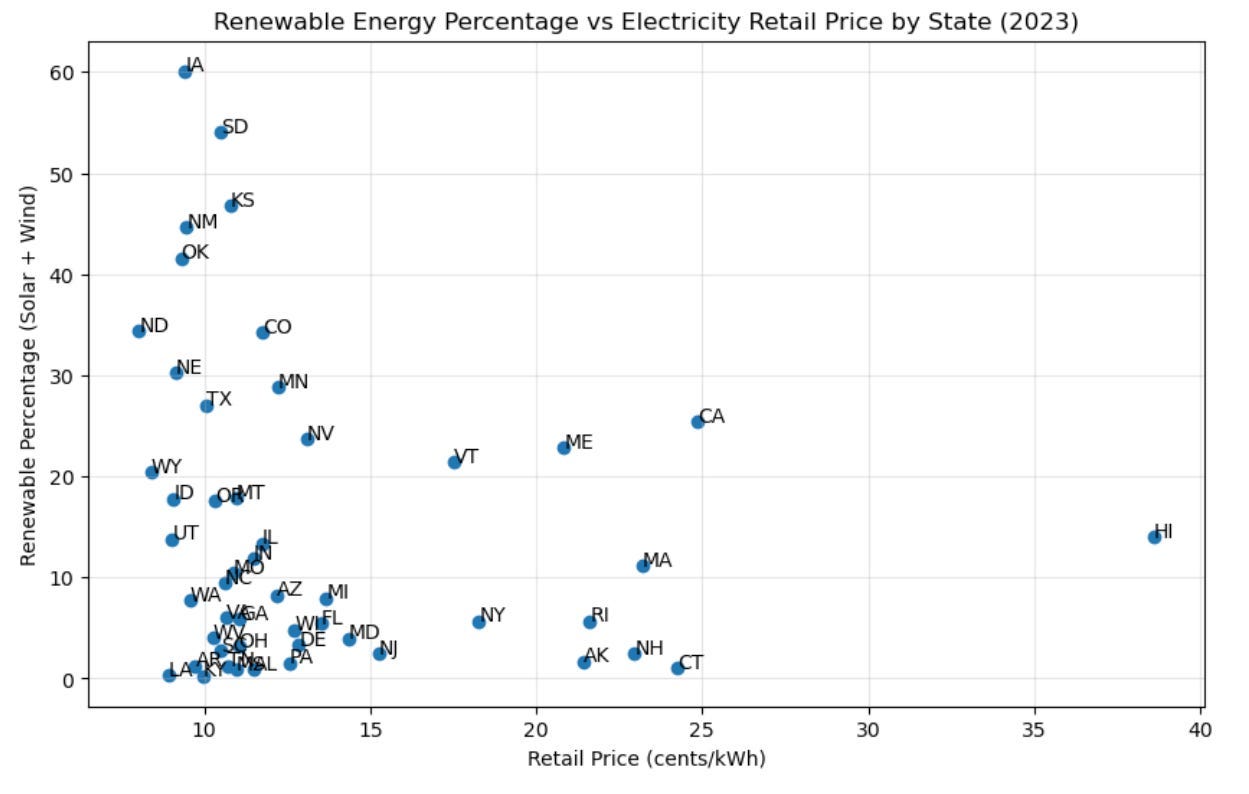

The US, due to its lower reliance on expensive imported gas provides a better picture of the cost saving effect of renewables.

Chart source: . Check out his post to get similar perspective from a Texas angle.

Transition to Net Zero power will help your electricity bills, it just requires conquering the masked (marginal) enemy first. 2024 already saw renewables setting record number of prices (even negative in many European countries). We are currently at the awkward stage there isn’t enough capacity to materially impact prices. Once a suitable capacity threshold is reached, the true benefit of zero marginal cost renewables can be reaped.

Thanks for reading Climate Current. This post is public so feel free to subscribe or share

Recommended read:

Good article, now I know why my bills are so high.

But why this? Shouldn’t it be an average?

That means that the final price passed on to consumers is solely dependant on what price the most expensive generator is charging.